Our experts analyzed the best high limit credit cards on the market to find the best options for you Here are our picks, including options with up to 5% cash back, long 0% intro APRs, and $0What is the 30% rule?While you can carry a balance up to the credit limit, that doesn't mean you should even if you have a higher credit line!

5 Tips For Lowering Your Credit Utilization Nerdwallet

30 of 2500 credit limit

30 of 2500 credit limit-Your credit limit is the maximum amount of funding that you can obtain from your charge card or line of credit If your charges and withdrawals exceed this amount, your credit card will be declined if you attempt to use it for purchases To avoid this problem, you can accept your card provider's option for overchargelimit protection In many instances, this will allow your overlimitYour first credit limit may be as low as $100 if your first credit card is from a retail store, but you might be approved for a slightly larger credit limit up to $500 if your first credit card is issued by a bank or credit card company It's unlikely that your first credit limit will be greater than $1,500 unless you already have a credit history, such as a mortgage or car loan on your credit

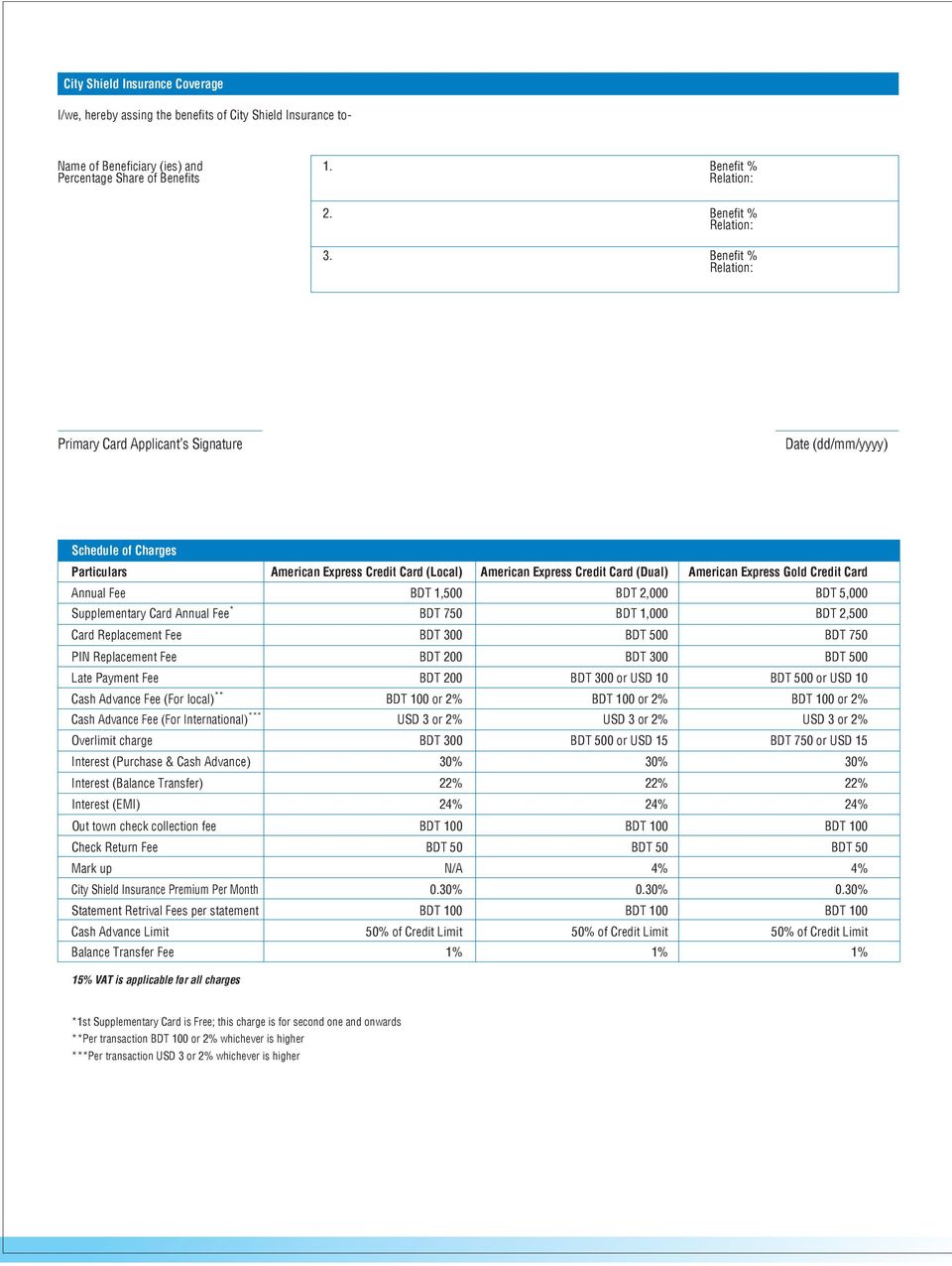

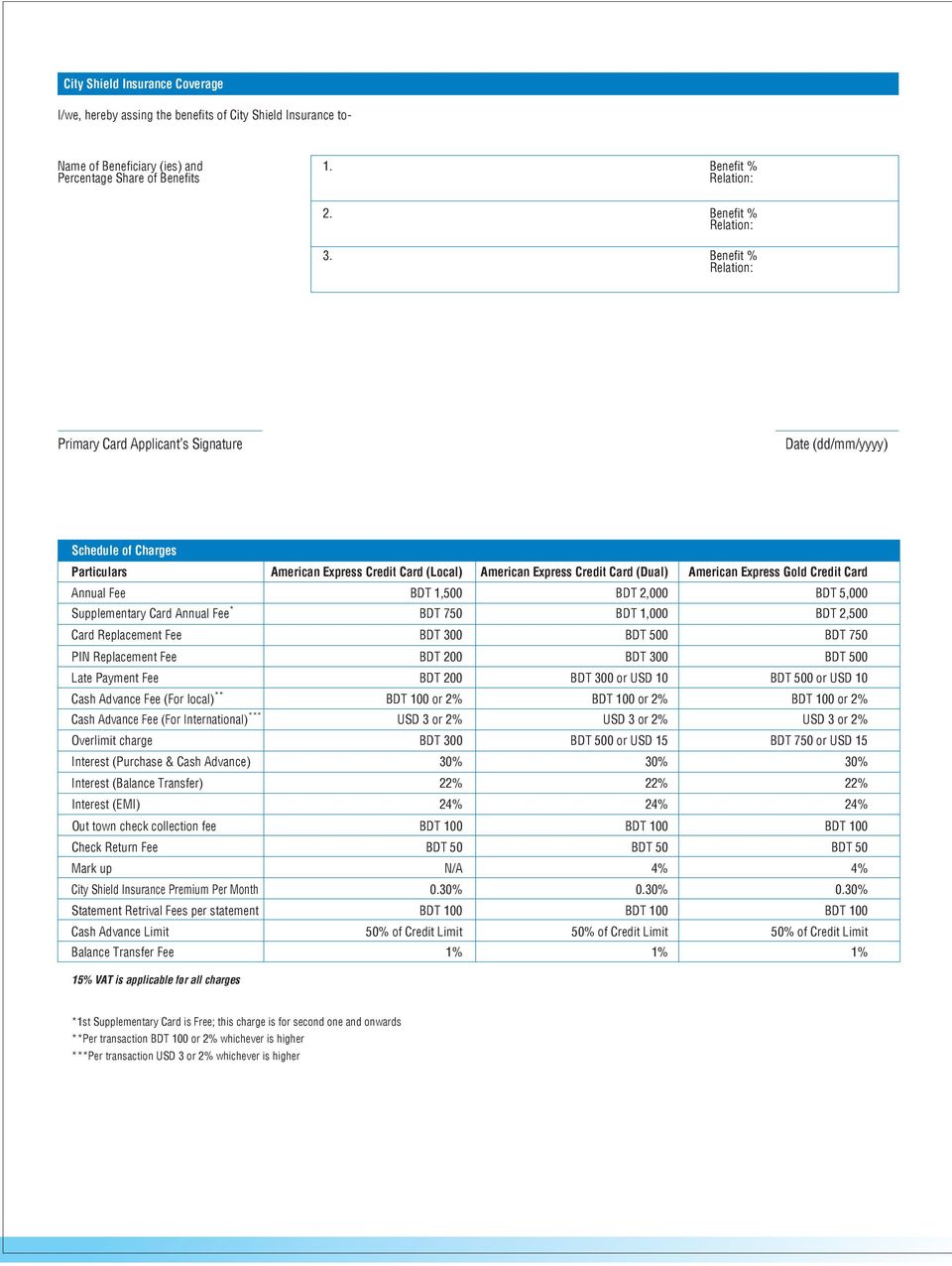

American Express Credit Card Application Form Pdf Free Download

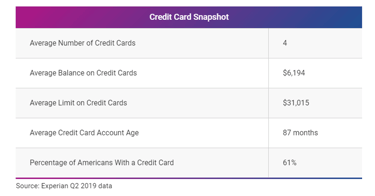

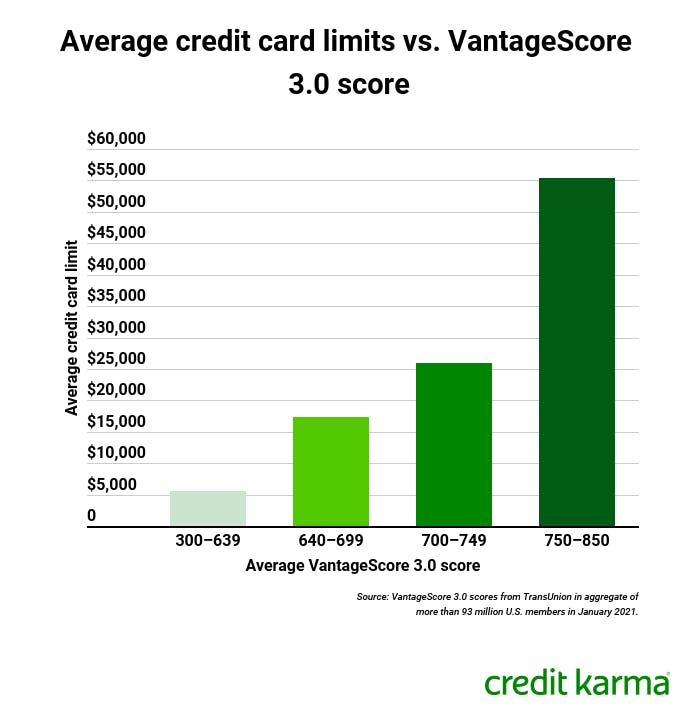

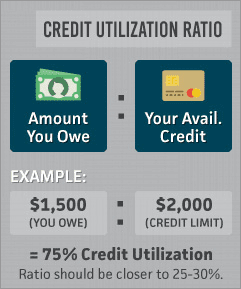

Updated available credit for new charges $2,500;The sum of your credit limits ($1,000 $3,000 $2,000) would equal $6,000 And your credit utilization ratio would be $1,0 $6,000 = or % A CUR of means you are currently using % of your total revolving credit— currently being the operative word, for your credit utilization ratio, like your credit score, represents aA 19 survey from Experian showed that the average credit limit increases with age For instance, with Generation Z (ages 18 to 22), the average credit limit is $8,062 In contrast, Baby Boomers (ages 55 to 73) have an average credit limit of $39,919

Education Credit Income Limit H&R Block University Details For the American Opportunity Credit the education credit income limit is as follows Single, head of household, or qualifying widow (er) — $80,000$90,000 Married filing jointly — $160,000$180,000 The Lifetime Learning Credit phaseout for your modified AGI Single, head of household, or qualifying widow (er) — $55,000Consider a credit card with a credit limit of $2,500 that's maxed out with a balance of the full $2,500 That's 100% credit utilization To hit the sweet spot of 10%, you need to carry a balance of no more $250 on that card No more than $750 is the 30% maximum upper limit Featured Topics >If you avoid using more than 30% of the credit limit on any one card, the overall usage takes care of itself There are strategies you can use to and make sure it stays below the recommended amount

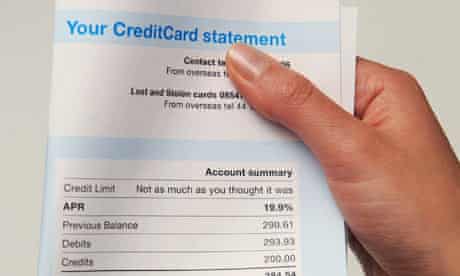

Articles on Mercantile Credit Management How to Set Credit Limits Credit Limits Line of Credit Although credit associates make a difference between 'line of credit and 'credit limit' and there are some legal ramifications for both but for the purpose of the following article we will leave the difference alone and treat them the sameThe average credit card limit in the UK is between £3,000 and £4,000, though the limit you get will very much depend on your income and credit history If you've a lower income and/or a poor credit history, you're likely to get limits starting around £0 with a maximum of £1,500 Yet, higher income earners with a good credit history could see limits of £10,000The Chase Slate credit limit is at least $500 and can be more, depending on how good your credit is Chase doesn't disclose a maximum credit limit, but you're always guaranteed a minimum of $500 if you're approved

What Credit Limit Will I Get When I Apply For A Credit Card

Best High Limit Credit Cards October 21 Find The Highest Limit

Has a minimum deposit (and credit line) of $0, but the card allows for a maximum credit limit of up to $2,500 with a deposit of the same size Check your balance, view transactions, and make payments using free online and mobile banking toolsSo, in this example, you have a credit line of $5,000, and you use the whole thing up by making purchases Then you make a payment for half the balance, which leaves you with half of your total credit limit available for new purchases Ideally, you should pay off your credit card balances in full every month (if you're notFor vehicles acquired after , the credit is equal to $2,500 plus, for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity, $417, plus an additional $417 for each kilowatt hour of battery capacity in excess of 5 kilowatt hours The total amount of the credit allowed for a vehicle is limited to $7,500

How To Read Understand Your Credit Report Credit Com Credit Report Credits Informative

Why That 30 Rule Of Thumb About Credit Card Use Could Be Costing You

Maxing out your credit cards can cause your credit score to take a hit, even if you pay your balances on time Amounts owed is the second most important category used to calculate your FICO credit score, accounting for 30 percent of your scoreYour credit utilization ratio, the amount of credit you use compared with your credit limit, is an important measure of thisExcellent, Good Some reviewers reported higher limits and lower scores, such as the person with a 662 score and a $15,000 limit But we've also seen higher limits, in the $30,000 to $50,000 range The minimum credit limit should be $5,000 because this is a Visa Signature®About 30 percent of your credit score comes from your credit utilization ratio — a number that tells creditors how much of your available credit you're using On a credit card with a $10,000 limit, for example, a $9,000 balance means you have a 90% credit utilization ratio for that card Such a high utilization ratio would hurt your credit score

Manish Wadekar Idea Cares Idea When Will Network Improve Let Me Know Data Buy Back Offers I Have Around 180gb For Sell

Best High Limit Credit Cards October 21 Find The Highest Limit

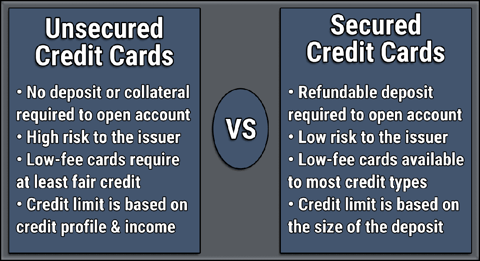

3 Credit Limits for Secured Credit Cards For a secured credit card, your credit limit is based on the amount of your security deposit (up to what the issuer has approved) For example, if you deposit $1,000 on your secured card, your credit limit is $1,000 4It's important to note that this may not be the credit limit you end up with For example, you could apply for a credit card that has a maximum limit of $10,000 but only end up being approved for a $2,000 limit instead Providers rarely share limit ranges for their credit cards As you might observe, business cards with high limits are common thanks to the nature ofCNBC Select looks into data on average credit card limits for firsttime cardholders, outlining what to expect and how you can eventually increase this amount Skip Navigation Latest Credit Cards Reviews Banking Loans Resources SEARCH CNBCCOM Share Share Article via Facebook Share Article via Twitter Share Article via LinkedIn Share Article via Email Our top

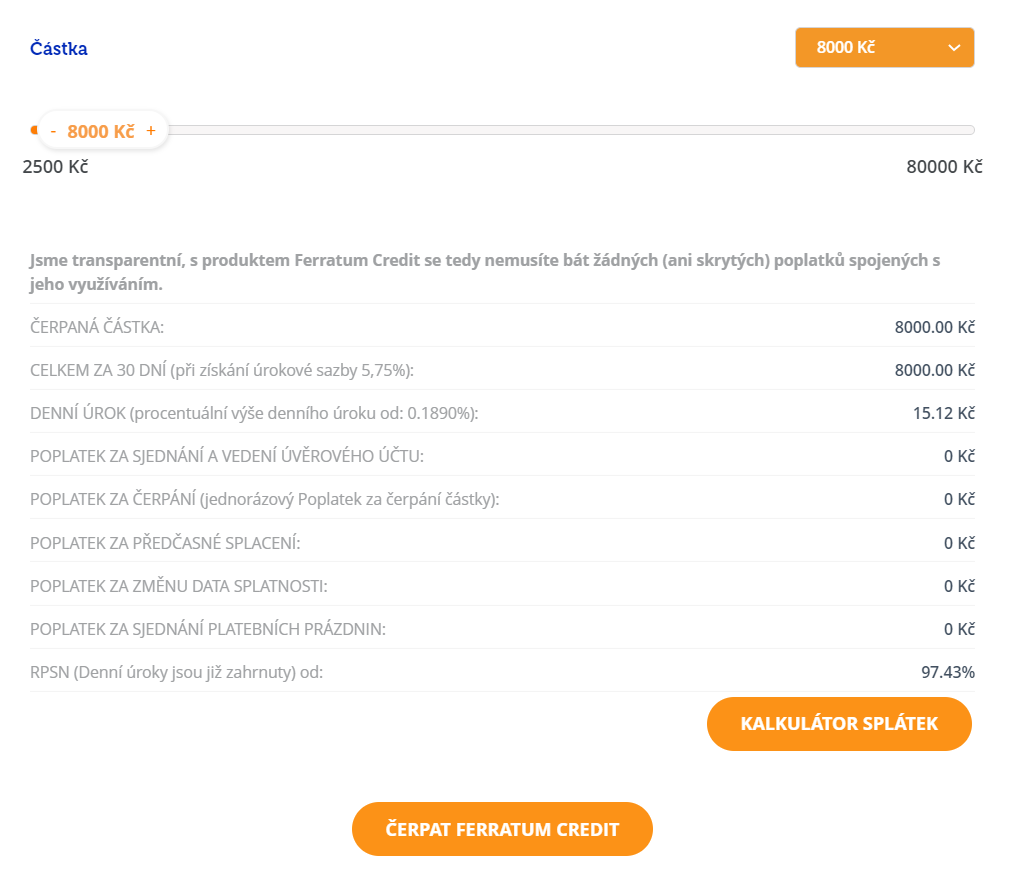

Ferratum Bank

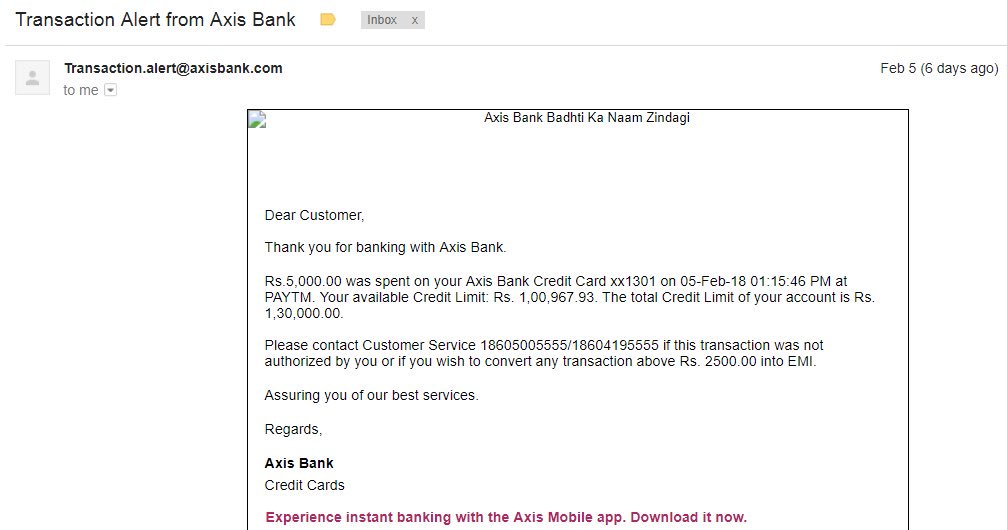

Ravi Jain Axisbank Axisbanksupport Axis Bank Is Very Prompt In Telling Me That Rs 5000 Was Spent From My Card But Wait I Don T Have An Axis Bank Card I

This type of increase typically lasts 30 days and is meant to help you cover emergency payments Another thing you can do is update your income records to the bank if you have received an increment, or have started a new (and better paying) job Banks may offer a new, higher credit card limit, though this process will take time – so only do this if you are not pressed for time Even IfFor example, if a card's balance is $2,500 and the credit limit is $5,000, then the result is 05 Multiply by 100 to see the result as a percentage—50% That is your credit utilization ratio for that card If you have multiple credit cards, add up all their balances and divide that total by the sum of the cards' credit limits Perhaps you have three cards with balances of $500, $1,500 and $0, and their credit limitsAs your revolving debt climbs, your credit score will begin dropping — long before it reaches the recommended utilization limit of 30% of your available credit

What S The Average Credit Limit On Your First Credit Card

How To Get Credit Records From A Credit Card To A Bank Account Pdf Free Download

I've heard that you can use up to 30% of your credit before your credit score starts dropping Is this 30% talking about per credit card or TOTAL credit limit?The best balance for any credit card is $0 Credit limit increases Your credit score is made up of your cumulative balances and credit limits across all cards For example, if you have one card with a $500 balance and $5,000 limit and another card with a $1,000 balance and a $1,000 limit, your credit score looks at it as $1,500 in balances out of a $6,000 limitScores lenders use >

Tax Credit In Tax Measures Of Evs Download Table

How Does The Credit Utilization Percentage Impact My Credit Score

Using less than 30% of your available credit is a guideline, not a rule The less credit you use, the better The less credit you use, the better NerdWalletI have a debit card that I use just to withdraw money from WF atms Recently someone racked up charges ~$2500 before WF cut them off I filed a police report and called WF that same day the charges posted on my account They recently got back to me today and claim that all my charges were authorized They were all at big box retailer shops I don't go to and my card has no activityHow I built my credit from $300 credit limit to $25,000!

1

1

Online Credit Limit Increase Request Log in to your online account Hover over the "Manage" button in the top navigation bar, then click "Credit Line Increase" Enter your total annual gross income, total available assets, employer name and monthly housing payment Requesting a credit line increase online with DiscoverA credit utilization ratio that exceeds 30% can raise a red flag, so if you have a credit card with a $10,000 limit, you should make a point toIn Xero, you can now block sales invoices for customers who are over their credit limitWarning it only works if you are using 'new invoicing'In this video

Citi Rewards Mastercard No Annual Fee For Life

5 Sneaky Ways To Improve Your Credit Score Clark Howard

I was just approved for a Citi Double Cash Credit Card today They definitely did their due diligence (I assume) considering it took about 9 days to approve me I have a Credit Score in the Excellent range (above 750) I was approved on the card for a $3000 limit but I guess I had $5000 in my head for no particular reason Is $3K an average credit limit?If you can handle the increased responsibility of a larger credit limit, applying for an increase is a savvy money move Here's how to increase your credit limitIf playback doesn't begin shortly, try restarting your device Videos you watch may be added

6 Simple Steps To Improve Your Credit Score

2

So, if someone has a total credit limit of $10,000 on their credit card or personal line of credit and they have already used $5,000, they would have the remaining $5,000 as available creditAn issuer offers credit cards with a certain credit limit This limit is the gross usable balance in your credit card It is the maximum amount you can spend without having to pay a penalty Credit card limit is, however, variable It is determineThe idea is simple – if you have a card or overdraft, only borrow 30% of your limit So if you have a £3,000 limit on your credit card, don't borrow more than £900

/how-to-calculate-your-credit-utilization-ratio-960473_V1-0558528520ca4e289bc0f25535ae3e7f.png)

How To Calculate Your Credit Utilization Ratio

30 Best Credit Cards In India For With Reviews Cardexpert

Data from credit bureau Equifax's Credit Trends report shows that the average credit limit for new bank card originations (brand new account openings) has been between $5,000 to $6,000 duringDelivery Time honeyb's review Applied on Sat 4/3/10 and was instantly approved Called today to find out the limit and was told $3500 and they are mailing the card out today Pulled TU TU 693 EQ 734 Write a new review for this card View all reviews for the Nationwide Bank®Don't exceed your credit limit If you've exceeded your card's limit once or more in the past, the provider would not look upon the same with favour, so it's ideal that you keep your expenses in check and stay well within the card's available limit Regular use Using your credit card regularly demonstrates that you are well aware of the spending and repayments cycle that a credit

How Does The Credit Utilization Percentage Impact My Credit Score

30 Percent Credit Rule Could Help Boost Your Credit Score

How to strengthen credit >Multiply by 100 to get your utilization ratio 25% Now imagine the credit limit on three of your credit cards gets cut in half These reductions bring your total credit limit to $7,000 Apply the same math above andI'm currently using about 11% of my total credit but a majority of that is from one credit card (that is

Can You Use Your Credit Card To Buy Beyond Your Card Limit The Economic Times

12 Best Loans Credit Cards For 400 To 450 Credit Scores 21 Badcredit Org

To calculate your total credit utilization ratio, divide your current balance by the total of all your credit limits, or $2,500 / $10,000 In this scenario, the result is 025;Then multiply 60 by 100 to get 60% If you want to calculate your credit utilization for all your accounts, first add all the balances Then add all the credit limits Divide the total balance by the total credit limit and then multiply the result by 100 The result is your overall creditHow to repair credit

12 Best Cards By Credit Limit 1k 10k 50k 100k

Tax Credit In Tax Measures Of Evs Download Table

Credit limit example If a credit card issuer gives you a credit limit of $2,500, that's the maximum amount you can have charged to the card at any given time If you spend $1,900 on your cardAs with all things credit, it depends Charging $23K on a $25K limit month over month and paying in full each time is not likely to be met with AA To the contrary, they'd probably up your limit Charging it up and starting to make minimum payments, especially if you are maxing out other cards as well, will most likely get you in trouble And then you've got a whole lot of grayTotal credit limit is the sum total of all limits on all of your credit cards You can calculate this yourself, or you should be able to find the number on your credit report Utilization rate is the balance due on a credit card as a percentage of the credit limit For example, someone who owes $2,000 on a card with a $10,000 limit has a utilization rate of percent Credit

What To Do If Your Credit Line Decreases And Why This Happens

Bernstein Cohen Associates Home Facebook

For example, if you have charged $5,000, and your credit limit is $10,000, then your credit utilization rate is equal to 50 percent To earn the best credit score, your credit utilization rate shouldn't exceed 30 percent of your credit limit This would mean that you'd have 70 percent of your credit available at all timesIf you have to use less than 30% of your total credit limit, you can use up to $ on your $ credit limitCreditors therefore base your credit limit on the minimum monthly payment that you can comfortably afford to pay given your disposable income For example, if your disposable income is around $100 per month and your credit card company requires a minimum payment of 4%, then your credit limit will likely be in the $2,500 range ($2,500 x 4% = $100)

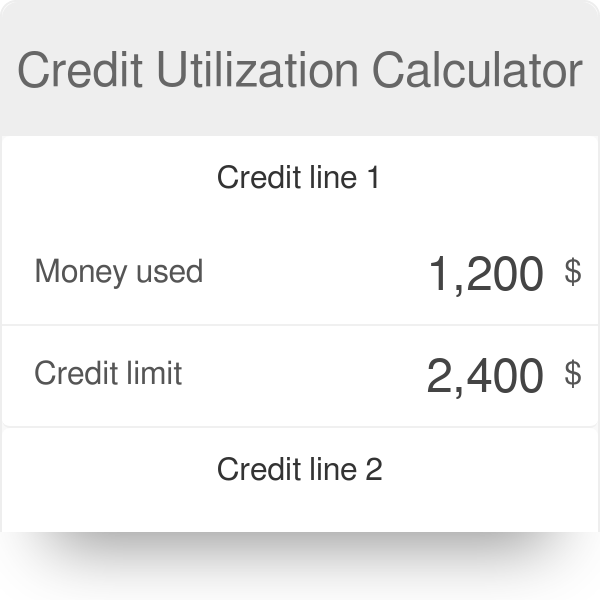

Credit Utilization Calculator

Credit Card Limits Everything You Need To Know Lexington Law

Barclaycard Cuts Customers Spending Limits By More Than 85 This Is Money

What Credit Limit Will I Get When I Apply For A Credit Card

30 Best Credit Cards In India For With Reviews Cardexpert

/howtoincreaseyourlimitonyourfirstcreditcard-07d537491b0648cdbc51438989360ca8.png)

The Average Credit Limit On A First Credit Card

When A Trucking Company Goes Above Their Credit Limit Operfi

How To Calculate Credit Card Utilization Experian

Ferratum Bank

Marg Care

How To Calculate Your Credit Utilization Ratio Nerdwallet

Best Secured Credit Cards Of October 21

How Much Of My Credit Limit Should I Use Us News

Credit Limit Management Credit Risk Strategy

30 Credit Utilization Rule Truth Or Myth Nerdwallet

Credit Utilization Consolidated Credit

What Is Credit Utilisation And Why Does It Matter Forbes Advisor Uk

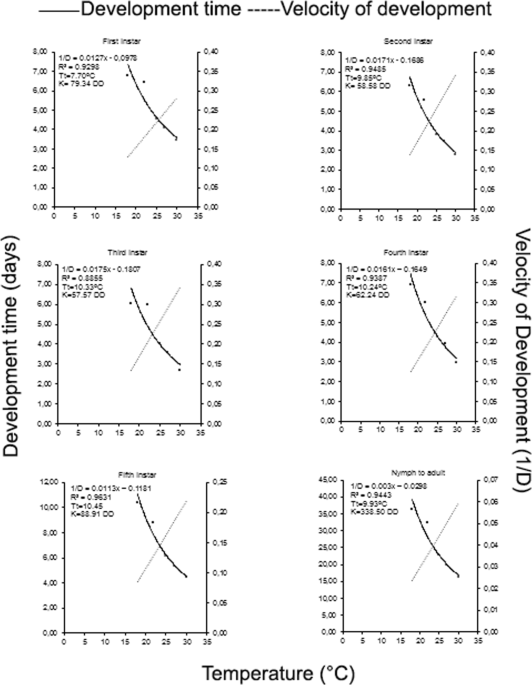

Biological Parameters Life Table And Thermal Requirements Of Thaumastocoris Peregrinus Heteroptera Thaumastocoridae At Different Temperatures Scientific Reports

30 Percent Credit Rule Could Help Boost Your Credit Score

Pujcka Maminkam Na Materske Smlouva Pujcka Penez

Best High Limit Secured Credit Cards Creditcards Com

30 Credit Utilization Rule Truth Or Myth Nerdwallet

American Express Credit Card Application Form Pdf Free Download

How To Increase Your Credit Limit

What Is A Credit Limit And How Is It Determined Credit Karma

Alahli Cards Credit Card Services

Credit Limits What Are They

3

Ham Radio Power And Energy Ham Radio Depends

What Happens When You Go Over Your Credit Limit

/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg)

How Your Credit Limit Is Determined

Can Credit Card Companies Reduce Your Credit Limit Without Warning Bankbazaar The Definitive Word On Personal Finance Can Credit Card Companies Reduce Your Credit Limit Without Warning

Credit Cards Online Apply For Instant Credit Card In 3 Easy Steps

1 000 Credit Limit Credit Cards For Bad Credit 21 Badcredit Org

/close-up-of-credit-application-form-184932708-5b798b7846e0fb00501a015e.jpg)

Possible Reasons Your Credit Limit Increase Was Denied

1 000 Credit Limit Credit Cards For Bad Credit 21 Badcredit Org

How To Get A Credit Card With A High Limit In 21

How To Calculate Your Credit Utilization Ratio Nerdwallet

5 Sneaky Ways To Improve Your Credit Score Clark Howard

How Many Credit Cards Should You Have Forbes Advisor

What Is A Credit Limit And How Is It Determined Credit Karma

8 Best Loans Credit Cards 500 To 550 Credit Score 21

13 Best High Limit Credit Cards For Bad Credit 21

Consequences Of Going Your Credit Limit Credit Com

Faq Equa Bank

Credit Card Limits Slashed Credit Cards The Guardian

Confidential This Presentation Is Provided For The Recipient Only And Cannot Be Reproduced Or Shared Without Fair Isaac Corporation S Express Consent Ppt Download

How Is My Credit Limit Determined

5 Tips For Lowering Your Credit Utilization Nerdwallet

How Do I Buy Bitcoin Ethereum Bitcoin Cash And More Using A Credit Debit Card Edge

What To Do After A Credit Limit Decrease 21

Best Ways To Improve Your Credit Score In 21

Jak Odesilat Textove Zpravy Z Pocitace

How To Increase Your Credit Limit

Turbocash5 Usa Online Help

Petal 2 Visa Credit Card Reviews 21 Credit Karma

Ferratum Bank

This Is What Happens When You Go Over Your Credit Limit Marketwatch

Skill 3 Minimize Credit Risk

Why That 30 Rule Of Thumb About Credit Card Use Could Be Costing You

Credit Limit

/GettyImages-952866958-18e700e1948441ad9fbe4c32b3a9d770.jpg)

Credit Utilization Ratio Definition

How To Apply Use Dhani One Freedom Credit Line Dhani Credit Line Activate Kaise Kare Dhani App Youtube

Best Credit Cards For Bad Credit Of October 21 Creditcards Com

How To Calculate Your Credit Utilization Ratio Nerdwallet

Solved 30 Of Your Credit Score Comes From Your Debt Measurements And Your Credit Utilization Rate Is A Big Factor In This Category Ozzie Has A Course Hero

2

Gjepc India The Banking Jewellery Financing 18 Seminar Would Also Address Specific Issues Pertaining To The Banking Diamond Jewellery Industries With The White Paper Being Presented By Gjepc

Credit Limit

1 000 Credit Limit Credit Cards For Bad Credit 21 Badcredit Org

16 Best High Limit Credit Cards For Excellent Credit

Max Our Credit Card Limits And Hurt Your Credit Learn Why Credit Com

How To Calculate Your Credit Utilization Ratio Nerdwallet

Credit Card Limit Too Low Don T Cancel Moneysavingexpert

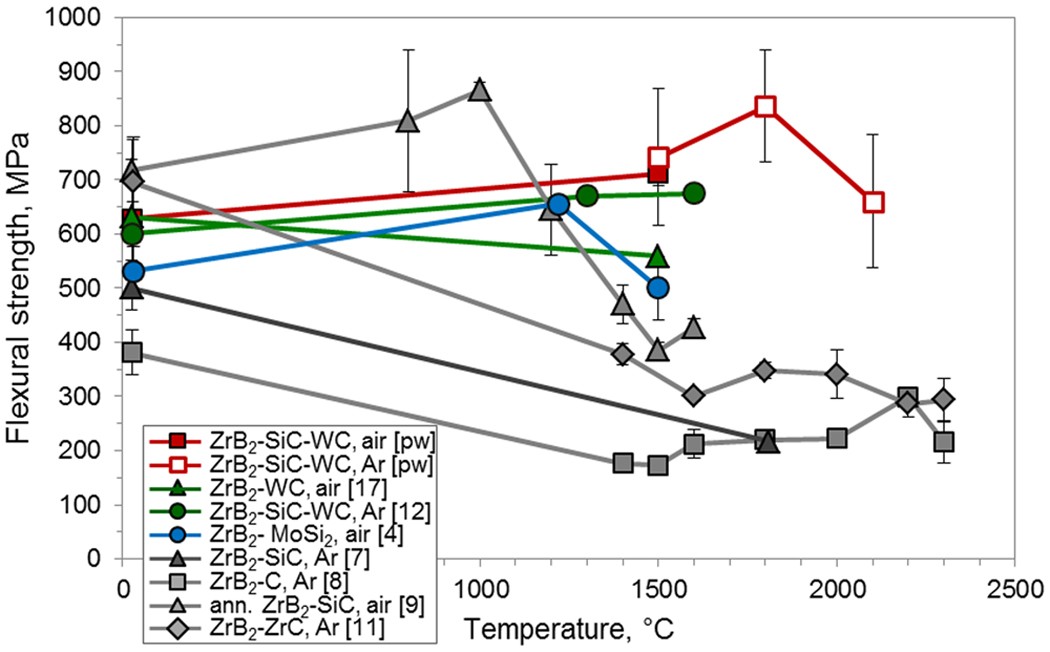

Super Strong Materials For Temperatures Exceeding 00 C Scientific Reports

2

0 件のコメント:

コメントを投稿